Synthetic intelligence is reworking practically each nook of the monetary world, and tax technique is not any exception. What as soon as required hours of handbook calculations, paperwork, and guesswork can now be streamlined by way of clever techniques able to analyzing huge quantities of knowledge in seconds. As tax legal guidelines develop extra advanced and monetary portfolios grow to be extra numerous, AI is rising as a robust software for people and companies looking for readability, effectivity, and lengthy‑time period financial savings. Understanding how AI is reshaping tax planning may also help taxpayers make smarter selections and keep forward of regulatory adjustments.

Smarter Knowledge Evaluation for Higher Resolution‑Making

One of many biggest strengths of AI is its capability to course of and interpret giant volumes of economic data rapidly and precisely. Conventional tax preparation usually entails sifting by way of receipts, statements, and information to establish deductions and credit. AI‑powered platforms can automate this course of by scanning paperwork, categorizing bills, and flagging potential alternatives for financial savings.

These techniques may also establish patterns in spending, investments, and earnings which will affect tax legal responsibility. For instance, AI can analyze historic knowledge to foretell future tax obligations or suggest changes to withholding and estimated funds. This degree of perception permits taxpayers to make knowledgeable selections all year long slightly than reacting at submitting time.

Personalised Tax Methods By way of Machine Studying

AI doesn’t simply course of knowledge, it learns from it. Machine studying algorithms can consider a taxpayer’s monetary conduct and tailor suggestions primarily based on their distinctive circumstances. This personalised strategy helps people and companies optimize their tax methods in ways in which generic software program can’t.

As an illustration, AI might counsel probably the most advantageous retirement contributions, spotlight underutilized deductions, or suggest timing methods for capital good points and losses. In areas the place specialised steerage is efficacious, similar to tax planning in Denver, AI instruments can incorporate native laws and state‑particular tax legal guidelines to offer much more correct suggestions. This degree of customization empowers taxpayers to maximise financial savings whereas staying compliant.

Enhancing Compliance and Decreasing Danger

Tax compliance is a serious concern for each people and companies. Errors—whether or not unintentional or attributable to misunderstanding—can result in penalties, audits, or delayed refunds. AI helps cut back these dangers by cross‑checking knowledge, figuring out inconsistencies, and guaranteeing that filings align with present tax laws.

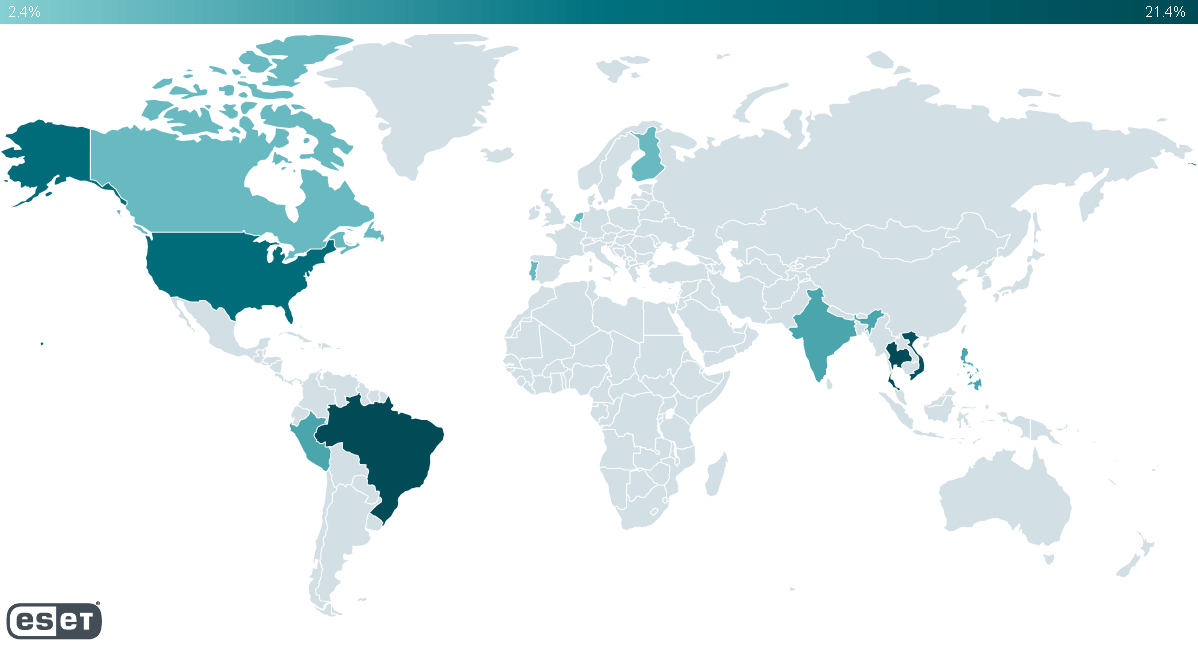

Many AI‑pushed platforms mechanically replace when tax legal guidelines change, eliminating the necessity for customers to manually monitor new guidelines or changes. That is particularly useful for companies that function throughout a number of states or nations, the place compliance necessities can range broadly. By minimizing human error and sustaining up‑to‑date data, AI helps extra correct and dependable tax filings.

Streamlining Enterprise Operations and Monetary Planning

For companies, AI presents important benefits past tax preparation. Clever techniques can combine with accounting software program, payroll platforms, and monetary administration instruments to create a seamless stream of knowledge. This integration permits firms to observe their tax place in actual time, forecast future liabilities, and plan strategically for progress.

AI may also help with advanced duties similar to depreciation schedules, stock valuation, and multi‑entity reporting. By automating these processes, companies unencumber useful time and sources that may be redirected towards innovation and growth. The result’s a extra environment friendly operation with a clearer understanding of its monetary well being.

Getting ready for the Way forward for Tax Technique

As AI continues to evolve, its function in tax planning will solely broaden. Rising applied sciences similar to pure language processing, predictive analytics, and superior automation are making tax technique extra accessible and intuitive. Sooner or later, taxpayers might depend on AI not only for preparation and compliance however for ongoing monetary teaching that adapts to their objectives and life adjustments.

Nevertheless, whereas AI presents highly effective instruments, human experience stays important. Tax professionals convey judgment, expertise, and strategic perception that expertise can’t replicate. The simplest strategy combines AI’s analytical capabilities with the personalised steerage of a talented advisor, making a balanced and ahead‑considering monetary technique.

Conclusion

AI is reshaping the way in which people and companies strategy taxes, providing smarter evaluation, personalised methods, enhanced compliance, and streamlined operations. By embracing these technological developments, taxpayers can cut back stress, enhance accuracy, and make extra knowledgeable monetary selections. As AI continues to develop, its influence on tax planning will solely develop, serving to form a future the place monetary technique is extra environment friendly, clear, and accessible than ever.